Resources

There’s always room for growth. Check out some of our plan information and insights that might help your business.

Plan Fees

Administrative Fees

Administrative fees cover all administrative costs of our plan, including participant recordkeeping, investment advisory, legal, audit, insurance/bonding, and custodial services. Administrative fees are deducted from participant accounts monthly on the first business day of each month. This monthly fee is composed of two components: a flat fee of $5, and a tiered asset-based fee which depends on the employee’s balance and the overall employer balance in the plan.

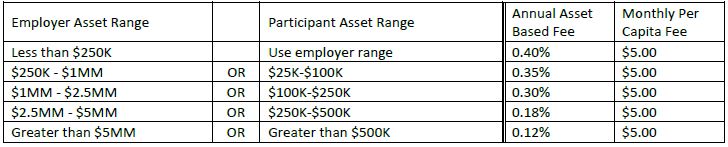

An employee’s asset-based fee percent will always be the lesser of the percent associated with their employer’s asset range or with his or her personal account balance. The following grid of employer and personal asset levels is used to determine an employee’s asset-based fee percent:

For example, a monthly plan fee for a participant who works for an employer in the $250K-$1MM asset tier and has a balance of $20,000 is calculated using the employer’s asset range as follows:

Monthly fee amount = $5 + ($20,000 balance)* (0.35%/12) = $10.83

For example, a monthly plan fee for a participant who works for an employer in the $250K-$1MM asset tier and has a balance of $260,000 is calculated using the participant’s asset range as follows:

Monthly fee amount = $5 + ($260,000 balance)* (0.18%/12) = $44.00

As of September 2023, the average participant administrative fee was 0.32%. Fees were even lower in 2021 and 2022 due to a 3-month fee holiday that took place each year in which no administrative fees were charged to participant accounts – all individuals effectively paid only 75% of the asset-based fee in the above tiers.

Investment Fees

Investment fees pay for the investment management of the individual investment instruments. Because they are applied daily and built into the daily share price of each fund, participants do not see a separate deduction from their accounts for investment fees. Participants can review their investment fee using the expense ratios for each fund provided on the annual fee disclosure. Investment fund expense ratios in the Plan range from a 0.035% to 1.10%. As of September 2023, the weighted average expense ratio was 0.17%.

Ongoing Review

Our goal is to offer a quality program that is competitively priced. We review our fees and investments quarterly. Plan growth and the resulting bulk buying power have allowed us to reduce fees every few years, and we continue to monitor for opportunities to make our plan even more valuable and affordable for employers of all sizes.